Business Insurance in and around Battle Creek

Calling all small business owners of Battle Creek!

This small business insurance is not risky

Insure The Business You've Built.

Do you own a window treatment store, a home cleaning service or a travel agency? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on what matters most.

Calling all small business owners of Battle Creek!

This small business insurance is not risky

Surprisingly Great Insurance

Your business thrives off your tenacity determination, and having dependable coverage with State Farm. While you lead your employees and support your customers, let State Farm do their part in supporting you with commercial auto policies, artisan and service contractors policies and commercial liability umbrella policies.

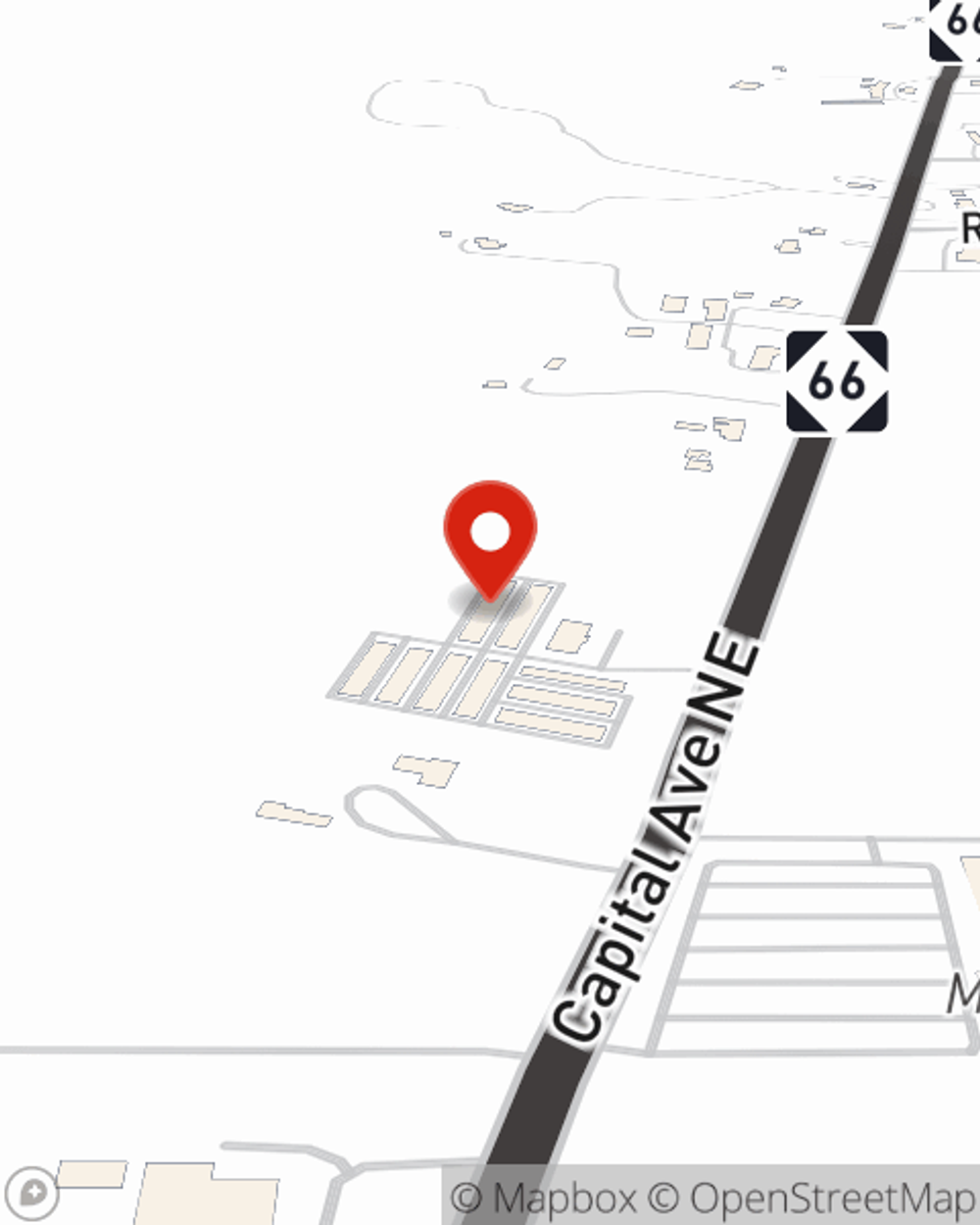

Since 1935, State Farm has helped small businesses manage risk. Visit agent Chase Anthes's team to discover the options specifically available to you!

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Chase Anthes

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.